Economists who analyze federal spending plans have looked at the numbers related to Bruce-Grey-Owen Sound Conservative MP Alex Ruff’s bill to remove the tax on the carbon tax.

The Parliamentary Budget Officer (PBO) recently published a costing note about eliminating the Goods and Services Tax on carbon pricing.

Ruff tabled his first private member’s bill in the fall. If it passed in the House of Commons, Bill C-358 would remove the GST from the Liberal government’s carbon tax.

Ruff says, “With the PBO’s recently published costing note, we now have a clearer picture of how much Bill C-358 could save taxpayers.”

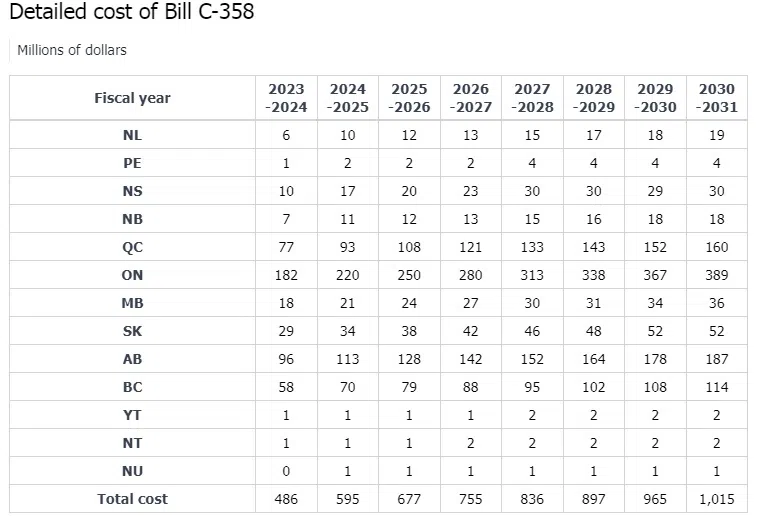

The PBO report estimates removing the tax on the carbon tax would reduce federal GST revenues by $486 million in 2023-24, increasing each year to $1.015 billion in 2030-31.

Ruff says that’s the amount Canadians would no longer be paying in taxes.

Each year, as the carbon tax increases, so does the GST on it. If you were to add the PBO’s annual year over year estimated totals from 2024 until 2030, it’s estimated to work out to $6.23 billion.

The federal government says on its website, “Putting a price on carbon pollution is widely recognized as the most efficient means to reduce greenhouse gas emissions while also driving innovation.”

Ruff says, “With the Liberal government failing to meet a single GHG emission target, it’s clear that the carbon tax is not an environmental plan, it’s a tax plan. However, the Liberals taking hundreds of millions of dollars more out of taxpayers’ pockets with this tax on the tax, it is just robbery.”

The Conservative Party of Canada says it will remove the carbon tax altogether, if elected.

Parliamentary Budget Officer calculates GST on the Liberal Carbon Tax is costing Canadians approximately $500 million per year. #AxeTheTax on the Tax. pic.twitter.com/AByLqptTrl

— Alex Ruff (@AlexRuff17) February 6, 2024

Below is the PBO report chart: